Objectives

Students will be able to:

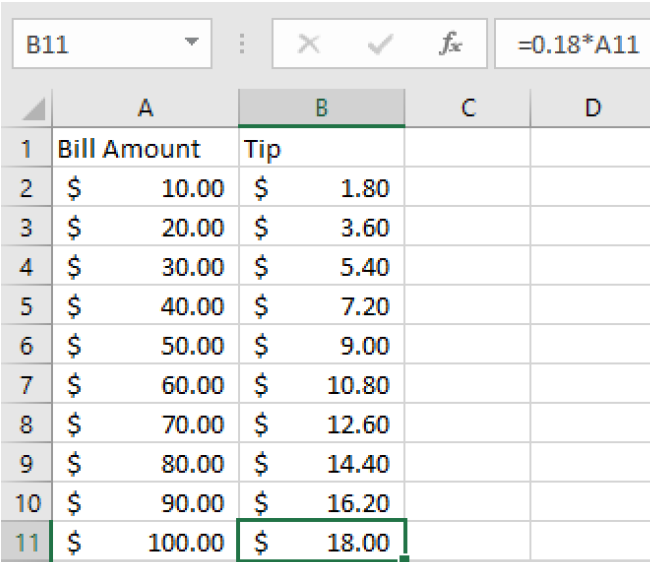

- Perform basic calculations on a spreadsheet

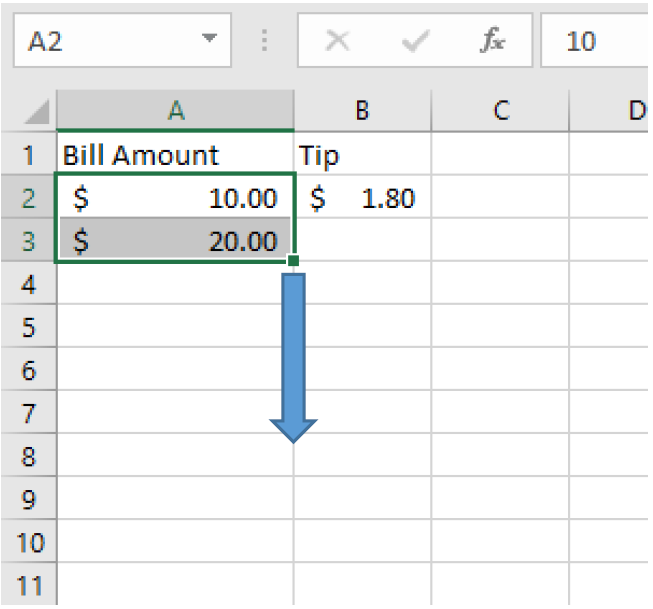

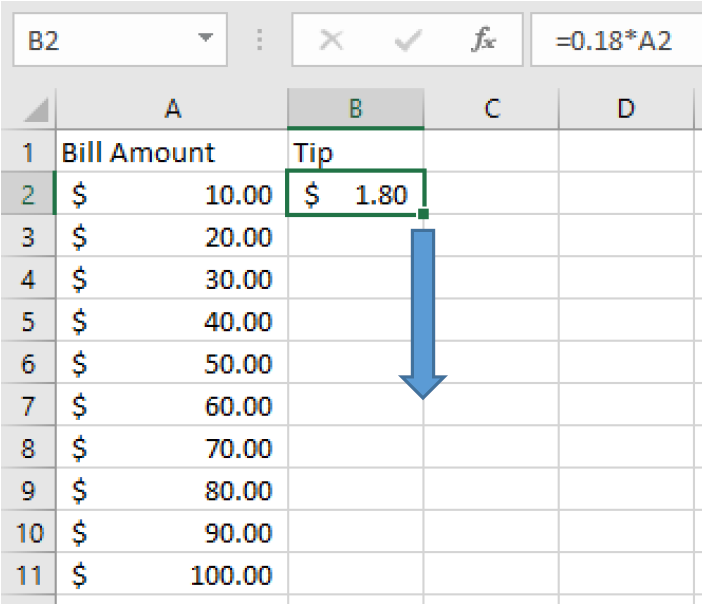

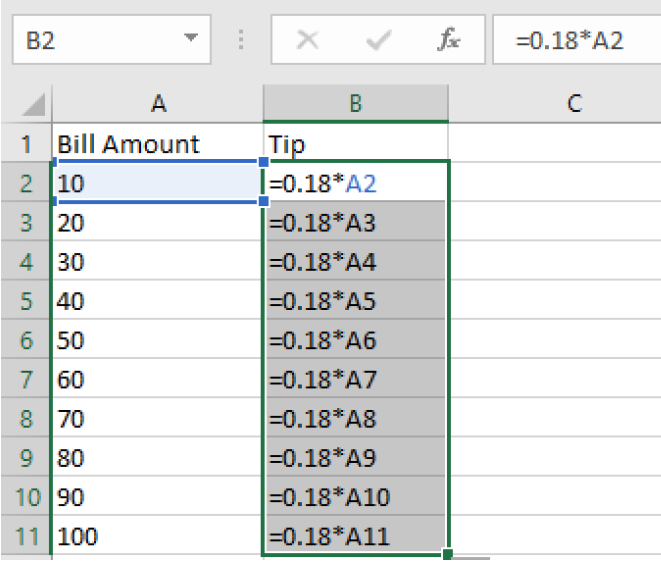

- Use cell references and the fill-down feature

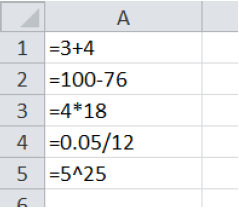

=3+4

=100-76

=4*18

=0.05/12

=5^25

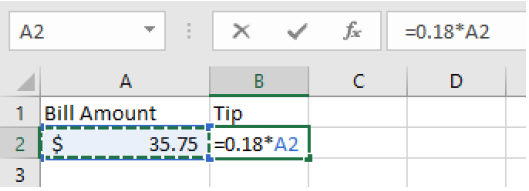

=0.18*35.75

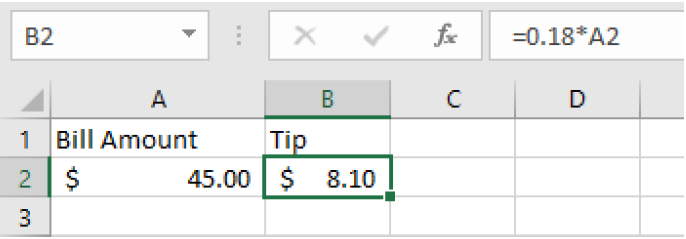

=0.18*A2

=FV to calculate the future values of an investment=PV to calculate the deposit needed for a desired future balance=PMT to calculate a loan or savings plan payment=EFFECT to calculate the effective rate of an account and compare accounts= 1000 * (103%) * (103%). Perform this computation in a spreadsheet and write the balance that you find.= 1000 * (103%)^2. Notice that the result here, which involves using a power, gives the same answer as you found in part (a). Comparing the two spreadsheet computations: Explain why they give the same result.